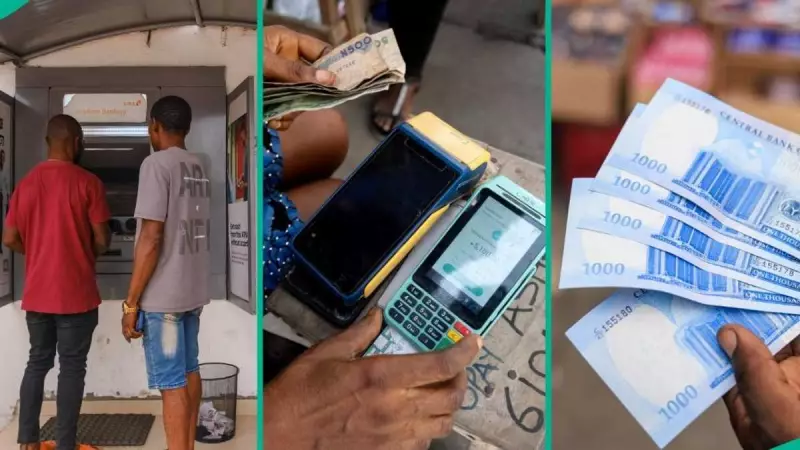

The Central Bank of Nigeria (CBN) has rolled out a significant revision to its cash handling regulations, setting the stage for a major shift in how individuals and businesses manage physical money. Financial institutions across the country have begun notifying their customers that the new framework will take full effect from January 1, 2026.

This policy overhaul, confirmed in messages from banks like Wema Bank to their clientele, is a strategic move by the apex bank. The core objectives are to refine cash management systems, bolster financial security, and accelerate the adoption of digital payment channels nationwide.

Key Policy Changes Effective January 2026

The revised guidelines introduce several critical adjustments. A major shift is the complete removal of limits on cash deposits. Starting in 2026, both individual and corporate account holders will be able to deposit any amount of cash without facing any charges, a move designed to streamline banking operations and bring more transactions into the formal financial system.

However, the policy introduces stricter and clearer limits on cash withdrawals:

- For Individuals: The weekly cash withdrawal limit is set at N500,000. Any withdrawal exceeding this cap will incur a processing fee of 3% on the excess amount.

- For Corporate Customers: Businesses will have a higher weekly limit of N5,000,000. Withdrawals beyond this threshold will attract a heftier fee of 5% of the excess sum.

It is crucial to note that the CBN has also discontinued the previous system of special approvals for higher monthly withdrawals. All withdrawals must now conform to the new weekly ceilings.

ATM Limits and Cheque Encashment Rules

The new policy also clarifies rules for Automated Teller Machine (ATM) transactions and cheque handling. The daily ATM cash withdrawal limit per customer remains at N100,000, contributing to a maximum weekly ATM withdrawal of N500,000.

Importantly, all cash withdrawals from ATMs and Point of Sale (POS) terminals will count toward an individual's or company's overall weekly cash withdrawal limit. This integration is meant to provide a holistic view and control over cash outflow.

Furthermore, the rule on third-party cheque encashment over the counter stays in place, capped at N100,000. The value of such cheques will also be deducted from the beneficiary's weekly cash withdrawal allowance.

Driving Nigeria's Cashless Future

Analysts view these revisions, as reported by Punch newspapers, as a decisive step by the CBN to modernize Nigeria's banking infrastructure and fast-track the transition to a cashless economy. By incentivizing electronic transactions through fees on high-value cash withdrawals, the CBN aims to mitigate the risks of theft, fraud, and the high cost of cash handling.

Banks are actively encouraging customers to embrace digital platforms for their transactions. Wema Bank's advisory, typical of the industry's response, urges customers to "take advantage of our digital banking channels for faster, safer, and more convenient transactions."

This policy shift aligns with other recent CBN directives, such as the order for banks and payment service providers to reconfigure ATMs and POS terminals to seamlessly accept foreign-issued payment cards, enhancing transaction efficiency for international users.