A young Nigerian man sparked widespread conversation online after he successfully recovered a substantial sum of money he accidentally sent to the wrong bank account. The incident, which involved a transfer of N800,000, highlighted both a common digital banking fear and a positive resolution.

The Costly Mistake and Immediate Call for Help

The man, who goes by the handle @ifedayo_johnson on social media platform X, shared his predicament with the public. He explained that the error occurred while he was attempting to make a payment to an individual. Instead, the funds were sent to the account of Mos Restaurant in Ijebu Ode, a food vendor he had transacted with a few days prior using his OPay app.

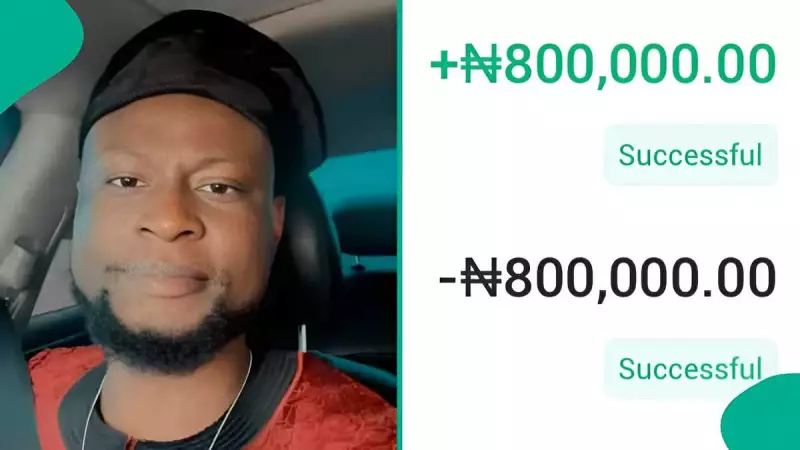

In a state of distress, he posted screenshots of the transaction online, appealing to his followers for urgent assistance. "I have just made an 800k transfer to a wrong account from my OPay," he wrote. He specifically asked if anyone near the restaurant in Ijebu Ode could physically intervene on his behalf that night.

OPay's Swift Resolution to the N800k Error

In a surprising and welcome update, the man later revealed that the issue had been resolved with remarkable speed. He reported that OPay had refunded the money almost immediately, even before he made his initial public post seeking help.

He detailed the simple process he followed: "I logged it as a transfer made in error on the OPay app and they acted almost immediately. Commendable." The man expressed his gratitude and satisfaction, stating, "Thank you @OPay_NG. I’m very impressed with this!" His experience showcased the efficiency of the fintech platform's customer dispute mechanism in this instance.

Mixed Reactions from Netizens on Fund Recovery

The story drew significant attention and varied reactions from other social media users, many sharing their own experiences with mistaken transfers.

User @realhighthee advised reporting directly to the bank or fintech company for a reversal. Others contrasted the positive outcome with more frustrating situations. @Oresanyaolumid1 shared a story of a similar error involving Moniepoint and Zenith Bank, where they were left waiting for a resolution.

Some questioned the legality of the reversal. @oyesinasalimon asked, "I’d like to know on what basis they reversed it; was there a court order or they asked for the consent to reverse it from the other acc?" This highlights common concerns about the protocols for reversing transactions.

Meanwhile, others lamented less fortunate outcomes. @marvellbaby noted a case where a smaller mistaken sum of N5,400 was not returned, and skjunior_001 mentioned a friend who was asked for a court order to recover N500,000. User @FramesPhcity used the opportunity to critique traditional banks, implying services like OPay are more responsive.

The incident serves as a cautionary tale about the importance of double-checking account details before sending money. However, it also provides reassurance that some financial service providers have effective systems to handle such human errors promptly. This case stands in contrast to other reported stories, such as that of a man who lost N100,000 to a wrong OPay account despite pleading with the recipient, or the lawyer who had his mistaken N20,000 payment returned by an honest POS vendor.