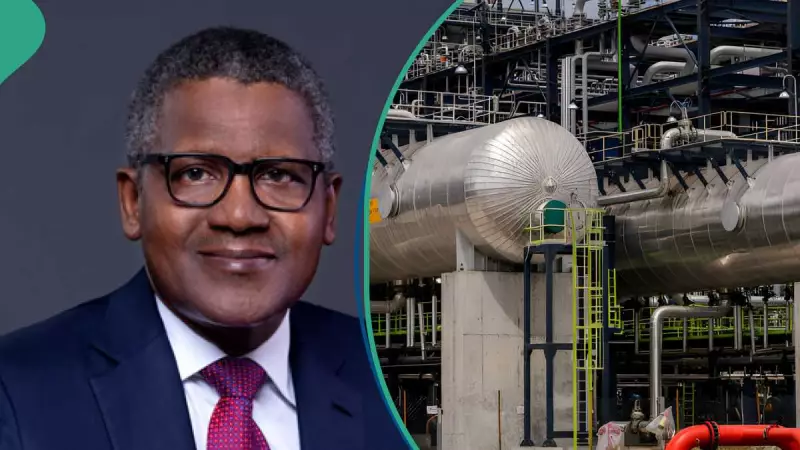

Nigeria's landmark Dangote Petroleum Refinery has initiated a significant, planned maintenance shutdown of its primary petrol-producing unit. This strategic pause in full crude processing is designed to enhance operational stability and unlock higher production volumes, with a target of reaching 700,000 barrels per day (bpd) by early 2026.

Strategic Shutdown for Long-Term Gain

According to industry reports, the refinery's residue fluid catalytic cracker (RFCC) has been taken offline for routine work. Devakumar Edwin, Vice President of Dangote Industries, confirmed the move, adding that the crude distillation unit (CDU) will also be suspended for a few days in January as part of the exercise.

Analysts emphasize this is not a sign of operational failure but a calculated de-bottlenecking effort. The maintenance aims to remove constraints that have prevented sustained runs at full capacity. Edwin noted that several plant sections have already outperformed initial design expectations, and the upgrade will increase the CDU's official capacity from 650,000 bpd to 700,000 bpd.

Nigeria's Fuel Landscape Transformed

The impact of the $20 billion Lekki-based facility on Nigeria's economy has been profound. Since starting operations, petrol imports have fallen by over 60%, easing foreign exchange pressure and insulating the country from global supply shocks.

Even while operating at roughly 85% capacity During this maintenance period, the refinery will not come to a complete halt. Management has stated that limited petrol volumes will continue to be produced via the reformer unit. Other secondary units, like the hydrocracker, will remain active, ensuring ongoing supply of diesel and aviation fuel. The refinery has assured the public of sufficient product availability through the holiday season to cushion the impact of the temporary slowdown. The shutdown is already causing ripples across regional energy markets. Traders in West Africa are preparing for tighter supply, and clean tanker rates from Europe have risen slightly as refiners there anticipate filling potential gaps. The long-term outlook, however, remains decisively positive. A successful ramp-up to 700,000 bpd by early 2026 would solidify Nigeria's position as a refining hub for Africa and drastically cut its historical reliance on imported fuel. This maintenance underscores a new phase in Nigeria's refining revival: the focus has shifted from start-up to fine-tuning for scale, resilience, and market dominance. In a related development highlighting its market influence, Dangote Refinery closed 2025 with a major reduction in petrol prices. Reports indicate it slashed its ex-depot rate by ₦200.50 per litre year-on-year, demonstrating how local refining is actively reshaping fuel economics in Nigeria.Limited Production Continues During Maintenance

Market Ripples and the Road Ahead