The Petroleum Products Retail Outlets Owners Association of Nigeria (PETROAN) has identified a consistent and reliable supply of crude oil to local refineries as the most critical factor for reducing the price of petrol and other fuels in the year 2026.

Core Challenges: Allocation, Vandalism, and Price Fluctuations

In its official outlook for 2026, the association pointed to several persistent issues that have destabilised the market. PETROAN, through its National President Billy Gillis-Harry and spokesperson Joseph Obele, specifically highlighted irregular crude allocation, pipeline vandalism, and unpredictable price changes as major hurdles. These factors, the group argues, have created a difficult environment for retail operators and sown uncertainty across the entire downstream petroleum sector.

The association emphasised that ensuring a steady flow of crude to Nigeria's domestic refineries would boost their production levels. This increase in local output is seen as essential to cutting the nation's dependence on imported petroleum products, which is a fundamental step toward stabilising pump prices nationwide.

Limited Impact of Naira-for-Crude Policy

PETROAN also provided an assessment of the naira-for-crude policy, which was introduced to allow refineries to purchase crude oil using the local currency instead of US dollars. While acknowledging the policy's potential, the association reported that its impact has been limited so far.

The policy faced significant implementation challenges, including delays in execution, disputes over pricing, and inconsistent crude allocations. PETROAN stated that improving transparency and guaranteeing timely crude supply are necessary to unlock the full benefits of this initiative in the coming year.

Price Wars and the Path Forward with New Refineries

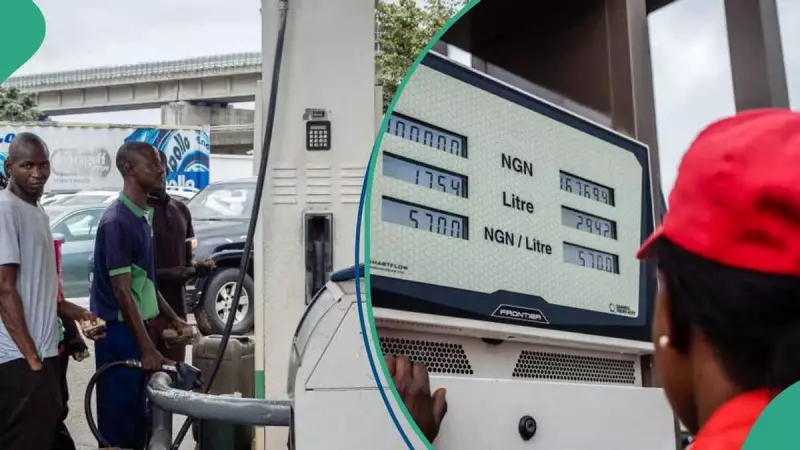

Reflecting on 2025, PETROAN described intense competition between fuel importers and local refiners as a "price war." This competition led to frequent changes in pump prices, resulting in heavy financial losses for retail operators and severely reduced profit margins. While consumers may have enjoyed temporary relief from lower prices, the association warned that such instability damages long-term investment confidence in the sector.

On a positive note, PETROAN welcomed the approval of more than 30 private refinery licences since the Petroleum Industry Act came into effect. The association noted that approximately 23 of these refineries are currently under construction and could collectively add over 850,000 barrels per day to Nigeria's refining capacity once completed.

This additional capacity, complementing existing large-scale refineries, is expected to significantly reduce Nigeria's reliance on imported fuel. To support this growth, PETROAN called for actions to improve crude supply security, strengthen pipeline protection, and ensure fair market competition.

Looking ahead to 2026, the retail owners' group urged policymakers to maintain a balanced approach. This includes keeping import options flexible to prevent supply shortages, encouraging alternative energy sources like Compressed Natural Gas (CNG) and solar power, and fostering continuous dialogue among regulators, refiners, and retailers. Achieving affordable and sustainable fuel prices, PETROAN concluded, will require combining robust domestic refining, secure supply chains, and transparent pricing mechanisms.