In a significant development concerning international energy politics, former United States President Donald Trump has announced a major deal involving Venezuelan oil. He stated that interim authorities in Venezuela are set to transfer a massive quantity of sanctioned crude oil to the United States.

The Announcement and the Plan

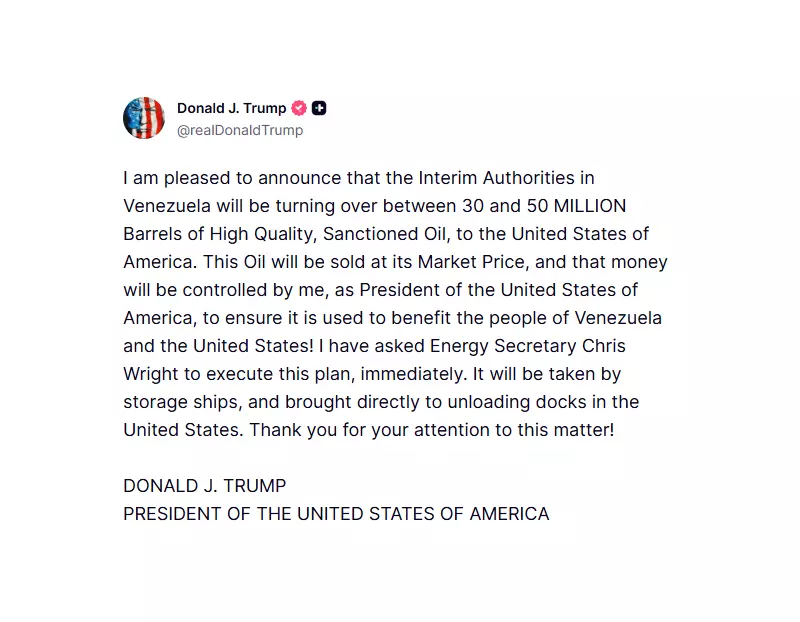

Making the announcement on his Truth Social platform, Trump declared that Venezuela will turn over between 30 million and 50 million barrels of high-quality, sanctioned oil to the United States. This action follows a recent military operation that removed President Nicolás Maduro from power. Maduro has reportedly been brought to the US to face charges related to drug trafficking and weapons.

According to Trump, the oil will be sold at its current market value. Crucially, he stated that the proceeds from this sale will be controlled by the United States. The former president emphasized that the funds would be used to benefit the people of both Venezuela and the United States.

Immediate Execution Ordered

Trump revealed that he has directed Energy Secretary Chris Wright to execute this plan immediately. The logistical operation will involve using storage ships to take the barrels of oil and transport them directly to unloading docks within the United States. This move is framed as a strategic step to manage resources following the political change in Venezuela.

The announcement came just one day after Delcy Rodríguez, formerly Venezuela's vice-president, was sworn in as its interim president. This shift in leadership paved the way for the proposed oil transfer, according to Trump's statements.

Context and Market Implications

This news aligns with Trump's previously stated views on Venezuelan oil production. Just a day before this announcement, he told NBC News that having Venezuela as an active oil producer is beneficial for the United States because it helps keep global oil prices down. The influx of 30 to 50 million barrels of oil onto the market, controlled by US interests, could have tangible effects on global energy prices and supply chains.

The deal represents a dramatic shift in the handling of Venezuela's sanctioned oil reserves. For years, US sanctions have severely restricted Caracas's ability to sell its oil on the international market. This proposed transfer would not only release a significant volume of that oil but also place the financial proceeds under American stewardship.

The situation continues to develop, with the international community watching closely to see how this plan unfolds and its impact on diplomatic relations, global energy markets, and the political future of Venezuela.