The Joint Tax Board (JTB) of Nigeria has officially launched a groundbreaking digital portal that will enable citizens and businesses to retrieve their Tax Identification Number (Tax ID) online without undergoing a fresh registration process. This unified system, which went live on January 1, 2026, links tax records directly with the National Identity Number (NIN) for individuals and the Corporate Affairs Commission (CAC) database for registered entities.

A New Era for Tax Administration in Nigeria

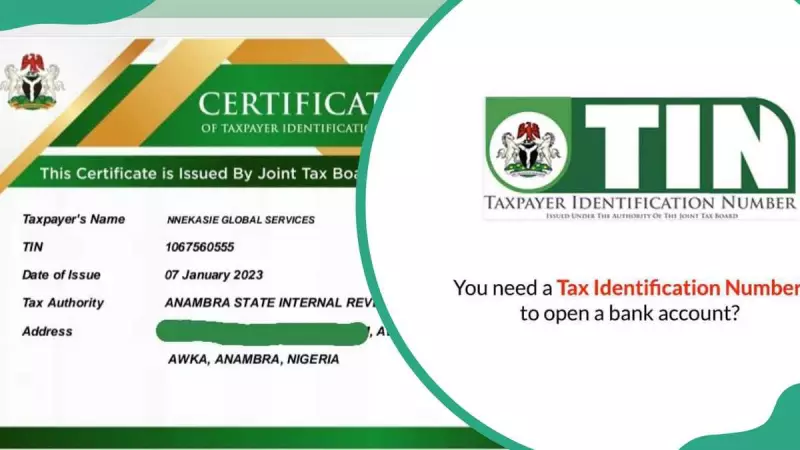

This initiative, announced via the official channels of the Joint Tax Board, marks a significant shift in simplifying tax administration across the country. The newly launched Nigerian Tax ID Portal serves as a single, nationwide access point designed to eliminate long-standing bottlenecks. For years, taxpayers have relied on physical visits to offices or intermediaries to obtain or recover their crucial 13-digit number, which is mandatory for tax compliance, banking, and numerous government services.

The portal is a key component of the broader tax reforms being implemented. The board now operates alongside the Nigerian Revenue Services (NRS), which has replaced the former Federal Inland Revenue Service (FIRS). Tax authorities believe this digital integration will improve data accuracy, strengthen compliance, and empower taxpayers by allowing them to confirm their details independently.

Step-by-Step Guide to Retrieve Your Tax ID

The process is streamlined and differs slightly for individuals and corporate entities. Below are the clear procedures provided by the Joint Tax Board.

For Individuals Using National Identification Number (NIN)

If you are an individual taxpayer, you can retrieve your Tax ID by following these steps:

- Visit the official portal at www.taxidjtb.gov.ng or www.taxidnrs.gov.ng.

- Click on the "Individual" tab located on the homepage.

- Select the "National Identification Number (NIN)" option.

- Enter your unique 11-digit NIN.

- Click on the "Retrieve Tax ID" button.

- Carefully enter your First Name, Last Name, and Date of Birth exactly as they are captured in the National Identity Management Commission (NIMC) database.

- Click "Continue" to proceed.

- Your 13-digit Tax Identification Number will be displayed on the screen.

For Businesses Using CAC Registration Number

Registered companies and organizations can access their Tax ID using their Corporate Affairs Commission details:

- Go to the portal: www.taxidjtb.gov.ng or www.taxidnrs.gov.ng.

- Click on the "Corporate" tab.

- Select the appropriate organization type from the options provided.

- Enter your official CAC registration number.

- Click on "Retrieve Tax ID".

- The system will instantly display your entity's 13-digit Tax ID.

Implications and Expected Benefits

The launch of this portal is more than just a technical upgrade; it represents a fundamental change in citizen-government interaction. By leveraging existing national databases, the system removes the need for duplicate registrations and drastically reduces the delays associated with manual verification processes. Taiwo Oyedele, the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has consistently emphasized that such changes are aimed at easing the burden on taxpayers, not at imposing higher rates or arbitrary revenue targets.

This move is expected to foster greater transparency, reduce opportunities for fraud, and encourage broader tax compliance by making the process straightforward and accessible from anywhere. It aligns with the government's push towards a more digitized and efficient public service framework, ultimately contributing to a smoother business environment and improved economic planning.