A Nigerian legal practitioner based in Dublin, Ireland, has publicly shared the specific charges levied by Access Bank on two separate transactions she made to send money back to Nigeria. The disclosure offers a concrete look at the costs borne by senders under the current financial framework.

Transaction Breakdown: N50 on N200k, N25 on N30k

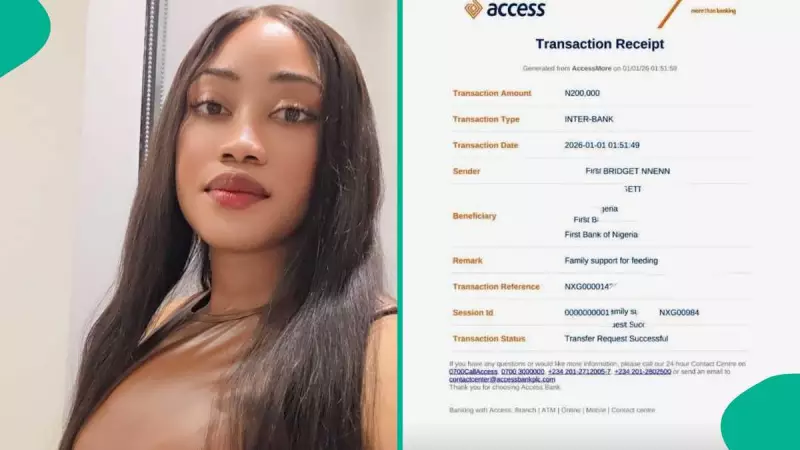

Barrister Bridget Nnenna carried out the two transfers on Thursday, January 1, 2026. She provided transaction receipts as evidence on her Facebook page. For a transfer of N200,000, Access Bank debited her account with two separate charges: N50 and N3.75. For a smaller transfer of N30,000, the bank charged her N25 and N1.88.

The lawyer noted the different payment narrations she used for each transfer. The N200,000 was tagged as "family support for feeding," while the N30,000 was for a "NEPA subscription." She also pointed out that Access Bank had informed her they would no longer charge the receiver for such transactions, indicating that the cost burden is shifting primarily to the sender.

Linking Taxation to Hopes for Good Governance

In her commentary accompanying the receipts, Bridget Nnenna connected the experience to the broader context of Nigeria's new tax laws. While acknowledging the financial impact on individuals, she expressed a hope that effective taxation could lead to tangible national benefits.

"Hopefully, with this development, we will begin to see better healthcare, improved infrastructure, access to basic amenities, and genuine efforts toward ending poverty and hunger in Nigeria," she wrote. She added that countries which successfully tax their citizens often correlate with good governance, expressing a sincere wish that Nigeria could be seen in the same light by 2026.

Public Reaction to the Revealed Charges

The lawyer's post sparked a range of reactions from social media users. Some expressed shock and frustration at the charges, with comments like "Which kind wahala person enter like this?" from Adaora Anvivia and "Oh my god" from Mubaram Ibrahim.

Other users questioned whether the deductions were actually the new taxes or existing bank charges. Sylva Emeka Ugwu commented, "I don't think they taxed you. In this enhanced tax regime, the sender ought not to be taxed but the receiver." Similarly, Excel Franca Ebirim stated, "My sister this is the normal billing they have been billing us for years, I believe this is not the tax own."

The discussion highlights public confusion and concern regarding the implementation and distinction between new tax policies and traditional banking fees on remittances, a vital financial lifeline for many families from the diaspora.