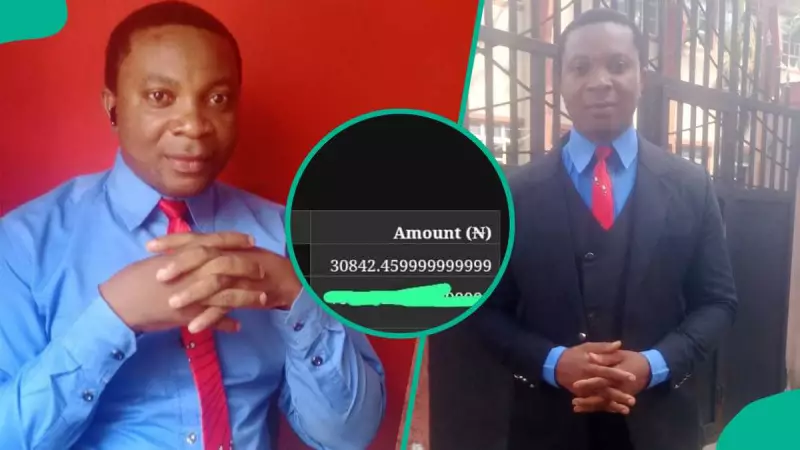

A Nigerian employee, Edidiong Johnson, has raised his voice in frustration after a significant portion of his November 2025 salary was withheld as tax. Johnson discovered the deduction when he checked his electronic payslip, revealing that a sum of N30,842 was removed under the Pay As You Earn (PAYE) system.

Shock and Disbelief Over November Payslip

Expressing his dismay on Facebook, Johnson wrote about the moment he saw the deduction. He stated that he had just checked his November payslip via mail and noticed that more than N30,000 was deducted as tax for the month. His post highlighted a common sentiment among many Nigerian workers, as he lamented, "Government is making a lot of money from us." He concluded his emotional post with a prayer, saying, "May God help us in 2026," a clear reference to the impending implementation of the new Tax Act 2025.

The Looming Shadow of the Tax Act 2025

Johnson's outcry comes amid widespread public concern and planned protests against the new tax laws scheduled to take effect in 2026. The PAYE system, which is already in operation, legally mandates employers to deduct income tax and other potential contributions directly from employees' salaries each pay period. The upcoming Tax Act 2025 is expected to bring significant changes to how personal income tax is calculated and collected, affecting a broad spectrum of the workforce.

Reactions to Johnson's post have been mixed, reflecting the national conversation on taxation. One commenter, Imaobong Duff, noted that under the new regime, taxes are expected to increase for high earners while potentially offering some relief for those with lower incomes. Duff, like many citizens, expressed hope that the substantial tax revenue would translate into tangible improvements in public services, including roads, healthcare, education, and infrastructure.

Legal Hurdles Cleared for New Tax Laws

In a related development, the path for the new tax framework was cleared by the judiciary. The Federal Capital Territory High Court, presided over by Justice Bello Kawu, dismissed a suit on Wednesday, December 3, that sought to halt the implementation of the recently enacted tax laws. The suit was filed by the Incorporated Trustees of African Initiative for Abuse Public Trustees, which requested an interim injunction against the Federal Government, the Federal Inland Revenue Service (FIRS), and the National Assembly.

The court found no legal basis to stop the reforms and ordered that they should proceed as scheduled. This ruling underscores the government's determination to move forward with the new tax policy, even as citizens like Edidiong Johnson voice their apprehensions about the financial impact on their already strained household budgets.