A young Nigerian man has taken to social media to voice his frustration after spotting a potential inconsistency in transaction alerts from Guaranty Trust Bank (GTBank). His post, which included screenshots of the messages, quickly went viral, igniting a fiery debate among netizens about bank charges and the newly implemented Nigeria Tax Act 2025.

The Viral Complaint and Alleged Discrepancy

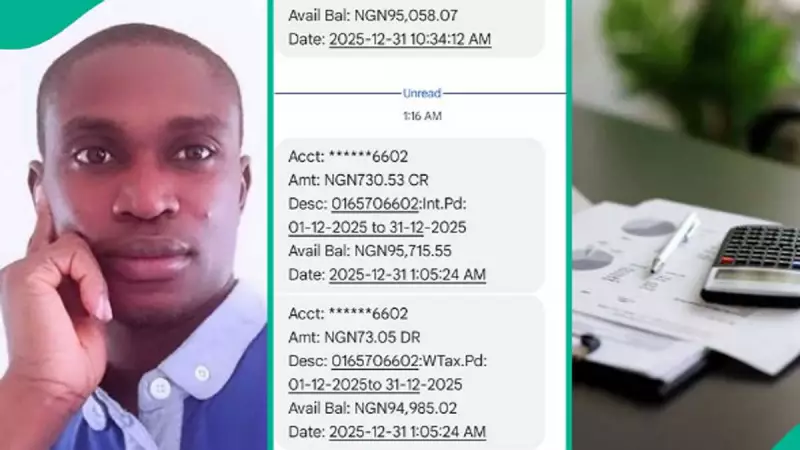

Twitter user @tammyjerry2 shared his experience on the platform, posting screenshots of two consecutive messages from GTBank. The first was a credit alert for N730, which reportedly brought his account balance to N95,715.55. Shortly after, he received a debit alert for N73.05 with a narration related to tax, supposedly leaving a new balance of N94,985.02.

However, the user questioned the bank's arithmetic. He urged his followers to scrutinize the figures carefully, implying that the deduction did not align correctly with the stated balances. In his tweet, he wrote: "You guys should see this. From @gtbank. If by 2027 we still have a country, Glory be to God. The tax deducted is how much? 73.05 naira. Minus that from the previous balance. Don't rush to comment, make use of your eyes and brain."

The complaint was made in response to ongoing online discussions about changes to stamp duty on electronic transfers under the new Nigeria Tax Act 2025.

Bank Response and Public Reaction

GTBank officially responded to the tweet, apologizing for the inconvenience and asking the customer to send a direct message to @gtbank_help for further assistance. The bank's reply stated: "Hello, thank you for contacting us. We sincerely apologize for any inconvenience this may have caused you. Kindly send us a direct message @gtbank_help with your complaint to enable us to assist Best regards."

The viral post drew a flood of reactions from other Nigerians, with many sharing similar experiences and concerns:

- Ali questioned the widespread criticism of the tax reforms, highlighting provisions meant to protect low-income earners.

- Rex accused GTBank of locking him out of his account for three days with no customer service response.

- Isk Utd reported a similar, smaller deduction of N2.8 from his First Bank account with a "tax something" narration.

- Sunday John warned that the real impact would be felt at Point-of-Sale (POS) terminals, predicting increased charges for cash withdrawals.

Broader Context of Banking and Tax Concerns

This incident is not isolated. Legit.ng had previously reported another case where a man claimed to have received only N63,000 after depositing N100,000 into his account, expressing shock at the substantial deduction.

The public outcry underscores a growing demand for transparency in banking transactions and clearer communication regarding new government fiscal policies like the Tax Act 2025. Many customers feel left in the dark about what specific charges are being applied to their accounts and why.

As digital transactions become the norm, such incidents highlight the critical need for financial institutions to ensure their systems are error-free and their customer communication is crystal clear to maintain public trust.