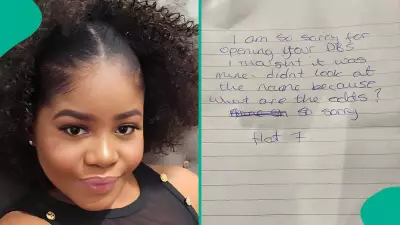

In a significant move to bolster customer protection in Nigeria's rapidly evolving digital banking sector, a prominent financial institution has launched a sophisticated device verification system designed to combat unauthorized account access and financial fraud.

Enhanced Security for Digital Banking Users

The innovative security feature represents a major advancement in protecting customers from the growing threat of cybercrime in the fintech space. As more Nigerians embrace digital banking solutions, the need for robust security measures has become increasingly critical.

How the New System Protects Customers

The newly implemented device verification system operates by recognizing and authenticating registered devices used to access banking services. This multi-layered security approach ensures that even if login credentials are compromised, unauthorized devices cannot gain access to sensitive financial information.

Key Security Benefits Include:

- Device Recognition Technology: The system automatically identifies and verifies trusted devices

- Real-time Alerts: Customers receive immediate notifications of login attempts from unrecognized devices

- Enhanced Authentication: Additional verification steps required for new device access

- Fraud Prevention: Significant reduction in account takeover risks

Addressing Nigeria's Digital Security Challenges

This security enhancement comes at a crucial time when Nigeria is experiencing rapid digital transformation in its financial sector. With increasing incidents of cyber fraud targeting bank customers, the implementation of advanced verification systems demonstrates the institution's commitment to customer protection.

The banking sector's proactive approach to cybersecurity reflects the growing importance of building customer trust in digital financial services. As more transactions move online, robust security measures become essential for maintaining consumer confidence and promoting financial inclusion.

Future of Banking Security in Nigeria

Industry experts anticipate that this move will set new standards for security protocols across Nigeria's financial technology landscape. The deployment of such advanced verification systems signals a maturing digital banking ecosystem that prioritizes customer safety alongside convenience and accessibility.

As Nigerian consumers continue to embrace digital banking solutions, the integration of sophisticated security features like device verification will play a crucial role in safeguarding financial assets and personal information in an increasingly connected digital economy.