In a startling revelation that has sent shockwaves through Nigeria's financial sector, the Department of State Services (DSS) has exposed sophisticated cyber fraud operations siphoning billions of naira from the nation's economy. The security agency's recent investigations have uncovered a complex network of digital criminals employing increasingly advanced techniques to defraud individuals and institutions alike.

The Scale of Digital Deception

According to intelligence gathered by the DSS, these cyber fraud operations represent one of the most significant financial threats facing Nigeria today. The sophisticated schemes target banking systems, mobile payment platforms, and unsuspecting individuals through various digital channels. The financial watchdog has documented cases ranging from unauthorized fund transfers to identity theft and corporate account compromises.

Evolving Criminal Tactics

The modus operandi of these cyber criminals has evolved significantly, incorporating:

- Advanced phishing techniques targeting financial institutions

- Social engineering attacks on corporate executives

- Malware infections compromising banking applications

- SIM swap fraud enabling unauthorized transaction approvals

DSS Counter-Offensive

The security agency has launched a multi-pronged approach to combat this growing menace. Their strategy includes enhanced digital surveillance capabilities, collaboration with financial institutions, and public awareness campaigns about cyber security threats. The DSS has also established specialized units trained in digital forensics and cyber crime investigation.

Inter-Agency Collaboration

Recognizing the transnational nature of cyber crime, the DSS has strengthened partnerships with international security agencies and financial regulatory bodies. This coordinated effort aims to track and dismantle the complex networks that facilitate these multi-billion naira fraud operations across borders.

Impact on National Economy

The financial hemorrhage caused by these cyber crimes extends beyond immediate monetary losses. Industry experts warn that persistent cyber fraud could:

- Undermine confidence in digital banking systems

- Discourage foreign investment in Nigeria's fintech sector

- Increase operational costs for financial institutions

- Damage Nigeria's international reputation in digital finance

Protective Measures for Citizens

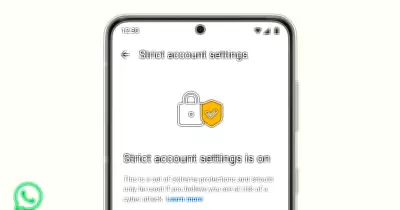

The DSS has issued guidelines for individuals and businesses to enhance their cyber security posture. These recommendations include implementing two-factor authentication, regularly monitoring financial statements, and exercising caution with unsolicited digital communications requesting personal or financial information.

The Road Ahead

As Nigeria continues its digital transformation journey, the battle against cyber fraud remains critical to safeguarding the nation's economic future. The DSS emphasizes that combating this threat requires collective vigilance from financial institutions, regulatory bodies, and the general public to create a secure digital ecosystem that fosters economic growth while protecting against sophisticated cyber criminals.