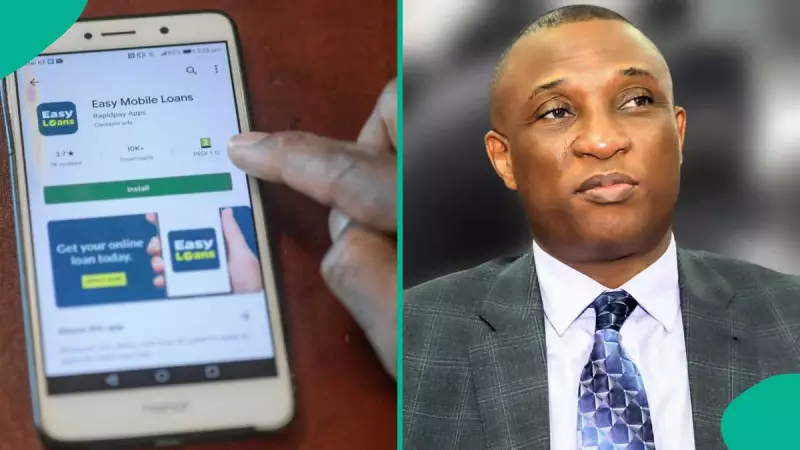

FCCPC Takes Action Against Non-Compliant Digital Lenders

The Federal Competition and Consumer Protection Commission (FCCPC) has initiated a significant enforcement drive against digital money lenders operating in Nigeria. This move comes as part of the implementation of the Digital, Electronic, Online and Non-Traditional Consumer Lending Regulations, 2025, commonly referred to as the DEON Regulations.

Deadline Passes for Regularization

Digital lenders that failed to regularize their operations by the January 5, 2026 deadline have now lost their conditional approval status. The FCCPC has officially declared these operators illegal and has begun removing them from its official register of approved digital lenders. This action marks the beginning of a phased enforcement process designed to strengthen compliance across the industry.

Consumer Protection at the Forefront

According to the Commission, the enforcement exercise aims to achieve multiple objectives. Primarily, it seeks to protect consumers from abusive lending practices while ensuring fair competition among legitimate operators. The FCCPC emphasized that this regulatory intervention is intended to restore market discipline and enhance transparency within Nigeria's rapidly expanding digital economy.

Structured Compliance Monitoring

The FCCPC's Executive Vice Chairman and Chief Executive Officer, Tunji Bello, confirmed that the compliance window for operators has officially closed. He explained that enforcement actions are being carried out systematically and fairly, with the Commission's goal being to improve consumer confidence rather than disrupt legitimate business operations.

As part of broader compliance monitoring efforts, the Commission has begun structured engagements with application hosting platforms and payment service providers. These collaborations are designed to ensure comprehensive oversight of the digital lending ecosystem, with additional regulatory steps planned in accordance with existing laws.

New Timeline for Conditional Approval Holders

For digital lenders that received provisional classification under transitional arrangements, the FCCPC has established a new deadline. These operators now have until April 2026 to complete their full registration under the DEON Regulations. Failure to regularize their status within this timeframe could result in further regulatory actions against them.

Background on Regulatory Framework

The DEON Regulations were introduced to address numerous concerns within Nigeria's digital lending sector. These include problems such as excessively high interest rates, misuse of personal data, aggressive debt recovery tactics, harassment of borrowers, and unhealthy competitive practices. The regulations represent a comprehensive effort to create a safer, more transparent digital lending environment for Nigerian consumers.

Public Advisory and Reporting Mechanisms

The FCCPC has advised members of the public to exercise caution when dealing with digital lenders that do not appear on its official register of approved operators. Consumers who encounter unregistered or abusive lenders are encouraged to report such incidents through the Commission's dedicated complaint portal. This reporting mechanism serves as an additional layer of consumer protection within the regulatory framework.

The Commission has reaffirmed its commitment to transparent regulation, fair competition, and robust consumer protection measures. As Nigeria's digital economy continues to grow, these enforcement actions represent a critical step toward establishing sustainable regulatory certainty in the financial technology sector.