Politics

Rivers Impeachment: Independent Group Clears Fubara, Calls Process 'Politically Motivated'

A new report by the Good Governance Advocacy Centre finds no evidence of gross misconduct against Governor Siminalayi Fubara, labeling the impeachment a political witch-hunt. Read the full details.

Business

Nigerian Stock Market Sees First 2026 Loss, N457 Billion Wiped Out

The Nigerian stock market closed in the red for the first time in 2026, with investors losing over N457 billion. Get the full details on the top gainers, decliners, and market analysis here.

Entertainment

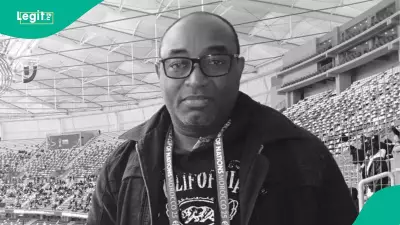

Saheed Osupa Donates Over N30 Million to 15 Nollywood Veterans

Fuji icon Saheed Osupa and his fan club have gifted over N30 million to 15 veteran Nollywood actors. Actor Afeez Owo shares a heartfelt appreciation video, sparking praise from fans.

Security

Peter Obi Mourns Omatu Brothers, Urges Emergency Reform After Lagos Fire Tragedy

Three Omatu brothers laid to rest in Anambra after Lagos high-rise fire. Peter Obi calls for urgent emergency service reform. Death toll rises to 10.

Sports

Education

Culture

Catholic Knight Protests, Diocese Responds on Ubah Legacy

A Catholic knight's public protest and renunciation of faith over the recognition of late Senator Ifeanyi Ubah's role in a cathedral project sparks a response from the Nnewi Diocese and a knighthood investigation. Read the full details.

Understanding Nigeria's Diverse Marriage Customs & Traditions

Explore Nigeria's vibrant marriage customs, from bride price negotiations to multi-day ceremonies. Learn about Yoruba, Igbo, and Hausa traditions, costs, and legal frameworks in this comprehensive guide.

Nigerian Lady Calls for Bride Price Ban, Sparks Debate

A Nigerian woman's viral TikTok video demanding the abolition of bride price has ignited fierce online debate. She argues the tradition promotes ownership and financial exploitation. Read the full story and reactions.

Mastering Nigeria's 371 Ethnic Food Traditions

Explore the rich culinary heritage of Nigeria, from communal cooking to 7 essential steps for mastering traditional dishes like jollof rice, egusi soup, and pounded yam. Discover how food defines identity.

Masquerade Attacking Singer at Ofala Festival Arrested

Anambra Police have arrested a masquerade for violent attacks at the Ofala festival in Awgbu. Read the full details of the incident and police action.

Health

Get Updates

Subscribe to our newsletter to receive the latest updates in your inbox!

We hate spammers and never send spam