In today's digital age, Nigerian bank customers face increasing threats from sophisticated phishing scams designed to empty their accounts. Cybersecurity professionals have identified several critical warning signs that every account holder should recognize immediately.

Is Your Money at Risk? Watch for These Red Flags

Cybercriminals are constantly developing new tactics to trick unsuspecting Nigerians into revealing their banking details. Being able to identify these warning signals could mean the difference between keeping your money safe and losing everything to fraudsters.

1. Suspicious Messages Claiming Urgent Action Required

One of the most common tactics involves messages that create artificial urgency. You might receive emails, SMS, or social media messages insisting that your account will be blocked unless you immediately verify your details. Legitimate banks in Nigeria rarely demand such urgent actions through these channels.

2. Unusual Login Attempt Notifications

If you start receiving multiple notifications about login attempts you didn't make, consider this a major red flag. Scammers might be testing your account security before launching a full-scale attack.

3. Unexpected Password Reset Requests

Receiving password reset emails you didn't initiate suggests someone is trying to gain unauthorized access to your account. Never click on these links unless you personally requested the reset.

4. Strange Account Activity Alerts

Even minor unfamiliar transactions should raise concerns. Fraudsters often make small test transactions to verify they can access your funds before attempting larger withdrawals.

How to Protect Yourself from Financial Fraud

Nigerian banking customers can take several proactive steps to secure their accounts:

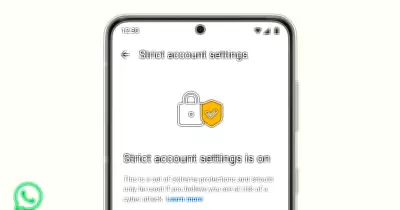

- Enable two-factor authentication on all your banking apps and online accounts

- Never share your BVN, OTP, or PIN with anyone through phone calls or messages

- Verify suspicious communications directly with your bank using official contact details

- Regularly monitor your account statements for any unusual activity

- Use strong, unique passwords for each of your financial accounts

What to Do If You Suspect Phishing

If you notice any of these warning signs, act immediately. Contact your bank's fraud department using the official number from their website or your debit card. Freeze your account if possible and change all your security credentials. Remember that Nigerian banks will never ask for your complete password or PIN through email or text messages.

Staying vigilant and recognizing these early warning signs can help protect Nigerian banking customers from devastating financial losses. In the ongoing battle against cybercrime, knowledge truly is your best defense.