Africa is experiencing a troubling trend of privately generated wealth flowing out of the continent to offshore financial centers, raising serious concerns among development experts and economic stakeholders.

The Lagos Gathering: A Continental Concern

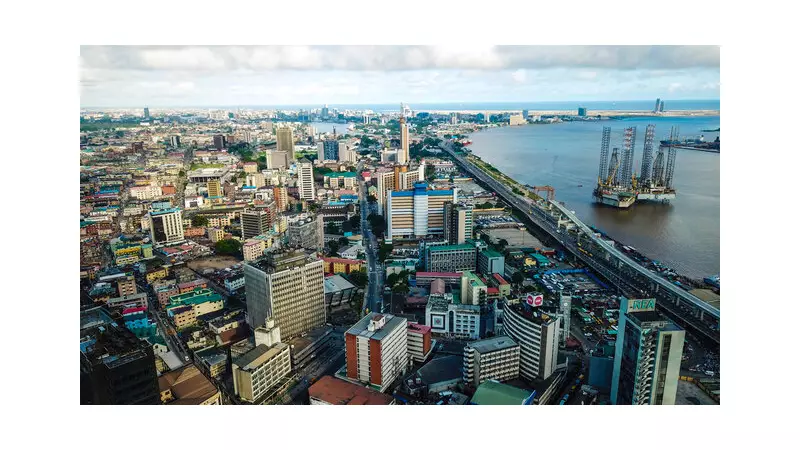

Economic leaders and development specialists converged in Lagos, Nigeria's economic hub, to address what they described as Africa's persistent challenge of wealth drainage. The media parley, organized by 7 Generations Institute (7GI) in collaboration with several prominent organizations including the United Nations Development Programme (UNDP) Regional Bureau for Africa, highlighted the urgent need for systems that retain capital within African economies.

Stakeholders unanimously agreed that Africa cannot accelerate its development without establishing stronger mechanisms that keep capital circulating domestically. The absence of well-governed Family Offices continues to weaken the continent's capacity to fund its own entrepreneurs, infrastructure projects, and innovation initiatives.

What Are True Family Offices?

Barry Johnson, Founder and Executive Chairman of 7 Generations Africa and 7GI, provided crucial insights into the concept of True Family Offices. He described them as comprehensive governance structures that anchor a family's values, relationships, decision-making processes, overall well-being, and preparation of future generations.

"When families govern these domains effectively, their money becomes better managed," Johnson explained. "Well-governed capital then becomes transformative, supporting entrepreneurs, strengthening national systems, and advancing the continent's development priorities."

The 7GI outlined a compelling theory of change demonstrating why Family Offices matter beyond wealthy households: properly governed families lead to well-managed capital; well-managed capital gets deployed more responsibly and productively; and when African private capital is deployed with clear purpose, economies become significantly more resilient.

Overcoming Obstacles to African Wealth Retention

Experts identified several challenges limiting the establishment of Family Offices across Africa. These include regulatory uncertainty, limited awareness about wealth management options, scarcity of expert guidance, and the historical tendency to export wealth offshore.

Sarah Stephen, Executive Director of 7GI, emphasized that strengthening family governance could reverse this damaging trend and redirect capital toward African-led ventures. "We create environments that help families learn, connect, and appreciate the catalytic role they need to play," Stephen stated.

She highlighted a sobering statistic: Most wealthy families worldwide lose their wealth within three generations. However, when African families establish True Family Offices, they not only preserve their wealth but intentionally reinvest it back into the continent's development.

The Lagos event, which took place on November 25, 2025, followed an earlier session in Nairobi on November 3. This gathering represents the second stop in an ambitious 15-country tour aimed at building the policy frameworks, capacity, and demand necessary to support the rise of true family offices throughout Africa.

Upcoming engagements are scheduled for Cape Town, Kigali, Rabat, and Abidjan, alongside plans for a continental Family Office Learning Network to enhance peer exchange and technical development across the region.