Nigeria's persistent inflation battle shows significant progress as declining food costs and a stronger naira push the rate closer to President Bola Tinubu's 15 percent target for 2025. The latest economic data reveals a multi-year low in inflation, offering hope to households struggling with the cost-of-living crisis.

October Inflation Figures Show Steady Decline

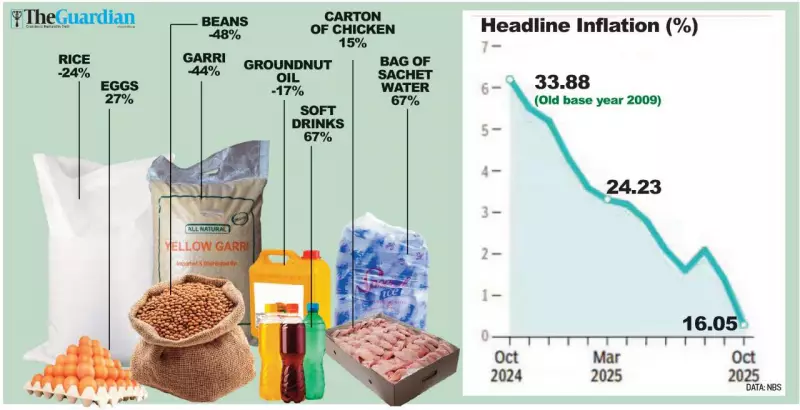

According to the National Bureau of Statistics (NBS), headline inflation eased to 16.05 percent in October 2025, down from 18.02 percent in September. This marks the sixth consecutive monthly decline, bringing the rate within 100 basis points of the government's promised 15 percent target.

The Consumer Price Index (CPI) report indicates food inflation moderated significantly to 13.12 percent year-on-year, a remarkable improvement from the 39.16 percent recorded in October 2024. The NBS attributes this decline primarily to easing food prices and stabilization in the foreign exchange market.

Major Food Items Experience Price Drops

Several staple foods have seen substantial price reductions over the past year. Rice, Nigeria's most popular staple, has dropped by 24 percent, with a 50kg bag now selling between N65,000 and N75,000 compared to N92,000 in November 2024.

Beans experienced an even more dramatic decline, with a 100kg bag of brown beans currently trading at N75,000 - representing a 48 percent decrease from last year's prices. Garri and onion prices fell by 40 to 70 percent, while tomatoes and pepper witnessed sharp drops of approximately 65 percent.

However, not all food items followed this trend. Egg prices remained unchanged, while some noodles increased marginally. In the manufacturing sector, prices proved stickier, with many goods maintaining elevated price levels despite the overall disinflation trend.

Naira Strength and Economic Implications

The Nigerian currency has shown remarkable recovery, gaining nearly N260 against the US dollar year-on-year. This represents over 15 percent appreciation in value, contributing significantly to inflation control through exchange rate pass-through effects.

The Central Bank of Nigeria (CBN) has responded to the improving inflation outlook by cutting the Monetary Policy Rate (MPR) by 50 basis points to 27 percent in September - the first rate cut since 2020. CBN Governor Yemi Cardoso has expressed optimism about achieving single-digit inflation, while President Tinubu continues to emphasize his administration's commitment to the 15 percent target.

Farmers Bear Brunt of Declining Prices

While consumers welcome lower food prices, agricultural communities face severe challenges. Farmers report negative returns on their 2025 investments, raising concerns about potential withdrawal from the 2026 planting season.

President of the Nigeria Agribusiness Group (NABG), Kabir Ibrahim, confirmed the difficult situation: "The harvest season has pushed food into the market, but people simply do not have money. Farmers must lower prices just to sell and buy what they need. It is discouraging when two bags of maize can barely buy one bag of fertiliser."

The Emir of Kano, Sanusi Lamido Sanusi, recently warned about the long-term consequences of food importation policies: "In bringing down food prices, we wiped out the profit of producers. Farmers who borrowed heavily cannot compete. Mills are shutting down, farmers are going bankrupt, and banks are now saddled with non-performing loans."

Structural Challenges and Economic Outlook

Despite the positive inflation trend, economists identify several persistent challenges. The Manufacturers Association of Nigeria (MAN) reported unsold inventory surged to N1.04 trillion in the first half of 2025, up from N896.2 billion in the second half of 2024.

Dr Muda Yusuf of the Centre for the Promotion of Private Enterprises (CPPE) noted that households still face significant pressure in critical areas including food, transportation, housing, energy, education and health, which collectively constitute 84 percent of Nigeria's inflation basket.

Prof. Chude Nwude of the University of Nigeria described the October figures as a "very positive development" but emphasized the need for addressing fiscal leakages and encouraging banks to lower lending rates for productive sectors.

As Nigeria approaches the government's inflation target, questions remain about whether the current disinflation reflects genuine economic recovery or masks deeper structural weaknesses in the productive sectors of the economy.