Fresh data revealing Nigeria's overwhelming dependence on sea transport for international trade has ignited renewed and urgent calls for the country to develop a robust indigenous shipping industry. The latest figures underscore a massive financial outflow, with experts pointing to governance failures as the core problem.

Maritime Dominance and a Staggering Financial Drain

The National Bureau of Statistics (NBS) Foreign Trade in Goods Statistics for the third quarter of 2025 paints a clear picture: maritime transport is the lifeblood of Nigeria's external trade. The data shows that goods worth a colossal N37.59 trillion were moved by sea during the period.

A detailed breakdown reveals that maritime transport accounted for N15.13 trillion or 93.84 per cent of the total value of imports. On the export side, the dominance was even more pronounced, with N22.46 trillion or 98.45 per cent of exports shipped via sea. In contrast, air and road transport played minimal roles, highlighting the sector's strategic importance.

Industry analysts argue that these numbers expose Nigeria's crippling reliance on foreign-owned vessels to move its own trade. This reliance persists despite the sector's proven potential to drive economic growth, generate foreign exchange, and create massive employment.

The Dormant Fund and a $100 Billion Annual Hole

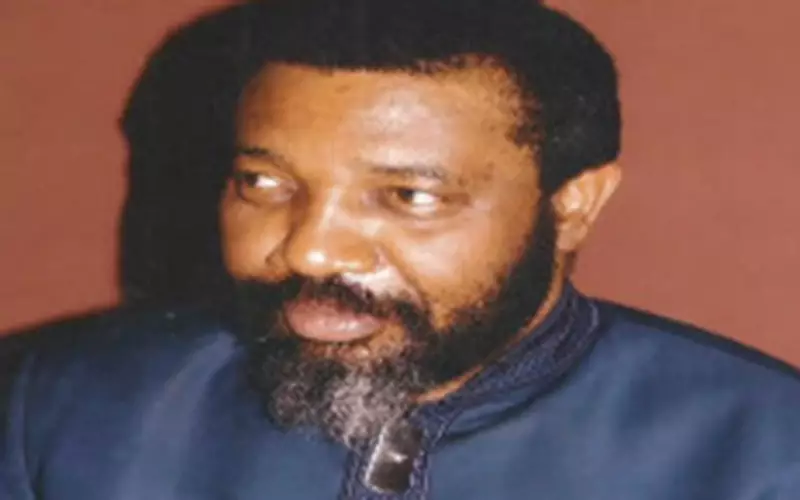

Dr. Eugene Nweke, Head of Research at the Sea Empowerment and Research Centre (SEREC), provided a stark assessment. He noted that while over 90% of Nigeria's trade moves by sea, indigenous fleet participation is abysmally low at less than five per cent. "This imbalance is a reflection of governance failures and not legislative gaps," Nweke stated.

The financial consequence of this imbalance is staggering. Nweke estimates that Nigeria suffers an annual loss of up to $100 billion. This hemorrhage stems from freight earnings paid to foreign operators, costs for expatriate employment, and capital flight within the oil and gas maritime logistics sector.

A central symbol of this failure is the Cabotage Vessel Financing Fund (CVFF). Established in 2003 to provide loans for Nigerian shipowners to acquire vessels, the fund has lain dormant for 18 years. Despite accumulating over $350 million, not a single major disbursement has been made. Nweke attributed this paralysis to bureaucratic bottlenecks, weak accountability, and political manipulation, leading to no national fleet and entrenched foreign dominance.

Charting a Course for Recovery and Maritime Sovereignty

To reverse this damaging trend, SEREC has recommended concrete actions. A key proposal is the establishment of a Cabotage Compliance Tribunal to expedite the enforcement of existing laws. They also insist on the transparent and urgent disbursement of the CVFF to credible indigenous operators.

Captain Ladi Olubowale, President of the African Shipowners Association (ASA), pointed to global examples. Nations like Japan, China, and Indonesia have established export funds for ship development, with their banks actively involved in financing. Olubowale maintained that unlocking the CVFF would transform Nigeria into a hub for qualified seafarers, with benefits rippling across the entire African continent.

The call to action is directed at the Federal Government, the Ministry of Marine and Blue Economy, NIMASA, and all industry stakeholders. The consensus is clear: a recommitment to the original vision of the Cabotage Act is essential to reclaim billions in lost revenue, empower local operators, and finally restore Nigeria's maritime dignity and economic potential.