Epstein Court Documents Cast Global Spotlight on Nigeria's Oil Sector Trust Deficit

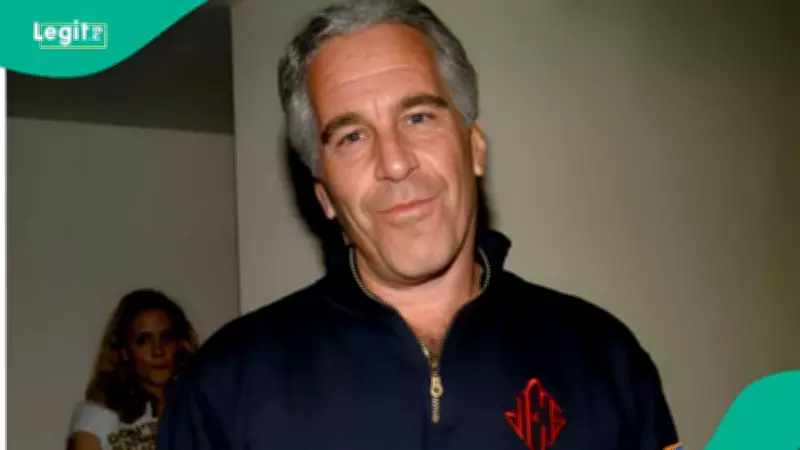

Newly unsealed court documents connected to the late American financier Jeffrey Epstein have unexpectedly thrust Nigeria's petroleum industry into international discussions about risk assessment and corporate reputation. The revelations come at a pivotal moment when Nigeria's energy landscape is undergoing significant transformation through both state-led initiatives and private sector innovation.

Epstein's Aborted Nigerian Crude Venture Reveals Deep-Seated Concerns

According to the recently released files, Epstein engaged in email correspondence during 2010 with an associate identified as David Stern, exploring potential opportunities to trade Nigerian crude oil through engagements with the Nigerian National Petroleum Company Limited (NNPCL). Initially attracted by the commercial prospects of Nigeria's globally sought-after crude blends, Epstein ultimately decided to withdraw from the prospective arrangement.

The financier reportedly expressed explicit concerns about potential fraudulent activities, choosing to abandon the deal despite its apparent profitability. This development presents a striking paradox: Epstein, who would later be exposed for orchestrating elaborate deceptive schemes himself, perceived Nigeria's oil sector as presenting unacceptable levels of operational risk.

NNPC's Persistent Governance Challenges Under Scrutiny

Epstein's apprehension reflects longstanding criticisms that have shadowed Nigeria's state oil corporation for decades. NNPCL has faced repeated allegations regarding opaque financial practices and failures to properly remit petroleum revenues to Nigeria's federation account. Multiple audit reports have consistently identified substantial financial discrepancies within the organization.

A comprehensive 2016 audit highlighted approximately $16 billion in unremitted revenues, while subsequent investigations revealed at least $1.48 billion in unaccounted funds. More recent examinations in 2025 cited over ₦210 trillion (equivalent to roughly $153 billion) in unexplained revenue flows, figures that continue to undermine investor confidence in Nigeria's petroleum governance structures.

Additional challenges plaguing the sector include:

- Persistent non-functionality of state-owned refineries despite substantial investment in maintenance

- Allegations of inflated contract values and inadequate oversight mechanisms

- Rampant oil theft and pipeline vandalism causing repeated production shutdowns

- Previous corruption cases involving Nigerian oil officials in international jurisdictions

The 2022 corporate restructuring of NNPC into a limited liability company under the Petroleum Industry Act was intended to establish a new era of commercial transparency. However, many industry observers contend that fundamental systemic issues remain inadequately addressed.

Dangote Refinery Emerges as Contrasting Model of Transparency

In stark opposition to these governance concerns, the Dangote Petroleum Refinery represents a transformative development in Nigeria's energy narrative. The monumental $20 billion facility, boasting a processing capacity of 650,000 barrels per day, has commenced exporting refined petroleum products including diesel and aviation fuel to European markets and gasoline to the United States, all meeting stringent Euro V environmental standards.

This landmark project has substantially reduced Nigeria's dependence on imported petrol, achieving the lowest import levels since 2017 and alleviating pressure on the nation's foreign exchange reserves. The refinery's operations have disrupted the longstanding crude-for-gasoline exchange arrangement that previously benefited European refiners by approximately $17 billion annually.

Dangote Industries is further expanding its strategic footprint through recently signed expanded gas supply agreements with NNPCL, securing essential feedstock to increase production output across its petroleum, fertilizer, and cement subsidiaries. These developments align with Nigeria's ambitious national targets to elevate gas production to 10 billion cubic feet daily by 2027 and attract over $60 billion in gas sector investments by 2030.

Divergent Narratives Shape Nigeria's Energy Future

The juxtaposition between the Epstein revelations and Dangote's achievements presents a compelling narrative about Nigeria's petroleum sector. While NNPCL continues grappling with credibility challenges accumulated over decades, private-sector initiatives like the Dangote Refinery demonstrate how operational transparency, substantial scale, and enhanced efficiency can potentially reposition Nigeria within global energy markets.

For international investors monitoring Nigeria's economic landscape, this contrast provides critical insights into the nation's evolving energy dynamics. The sector continues to demonstrate both persistent challenges and promising innovations as Nigeria navigates its complex petroleum future.