Asian stock markets staged a recovery on Tuesday, December 2, 2025, shaking off the previous day's jitters. The rally was powered by growing confidence that the US Federal Reserve will cut interest rates, which helped calm nerves over a sharp rise in Japanese government bond yields.

Fed Rate Cut Optimism Fuels Market Sentiment

Expectations for the Federal Reserve to lower borrowing costs have given global markets a significant boost in recent weeks. This optimism has allowed markets to recoup losses from early November, which were driven by fears of a technology bubble. The belief that the US central bank will ease monetary policy for a third consecutive meeting has strengthened. This shift follows comments from several Fed officials indicating that protecting jobs is now a higher priority than controlling elevated inflation.

Recent economic data from the United States has supported this outlook. Figures show the US economy, and particularly its labour market, is softening, while inflation appears to be stabilising. The latest evidence came from a survey by the Institute for Supply Management, which revealed that manufacturing activity contracted for the ninth month in a row.

Japan's Bond Market Moves and Regional Performance

Market movements in Asia were mixed at the start of the week but resumed their upward trend on Tuesday. Key indices in Hong Kong, Sydney, Seoul, Singapore, Taipei, Wellington, Manila, and Jakarta all posted gains. However, Shanghai's market experienced a slight dip.

Tokyo's Nikkei 225 also advanced, recovering some of Monday's losses. Those losses were triggered by remarks from Bank of Japan Governor Kazuo Ueda, which hinted at a potential interest rate hike this month. His comments boosted the yen and caused a spike in Japanese government bond yields. The yield on two-year bonds rose past 1%, reaching its highest level since the 2008 global financial crisis.

Fiona Cincotta, a senior market analyst at City Index, noted that Ueda's statements could signal a shift in the popular 'carry trade'. This strategy involves borrowing yen at low cost to invest in higher-risk assets. "A higher rate in Japan could suck liquidity out of the markets. Tech stocks and crypto are particularly sensitive to even the smallest shifts in liquidity," Cincotta wrote.

However, other analysts suggested a rate hike might not be imminent. Rodrigo Catril of National Australia Bank pointed out that Governor Ueda also stressed the need to confirm wage growth momentum ahead of next year's negotiations. This implies the Bank of Japan's December meeting might be too soon to make a decisive move.

Samsung's Bold Launch and Key Financial Figures

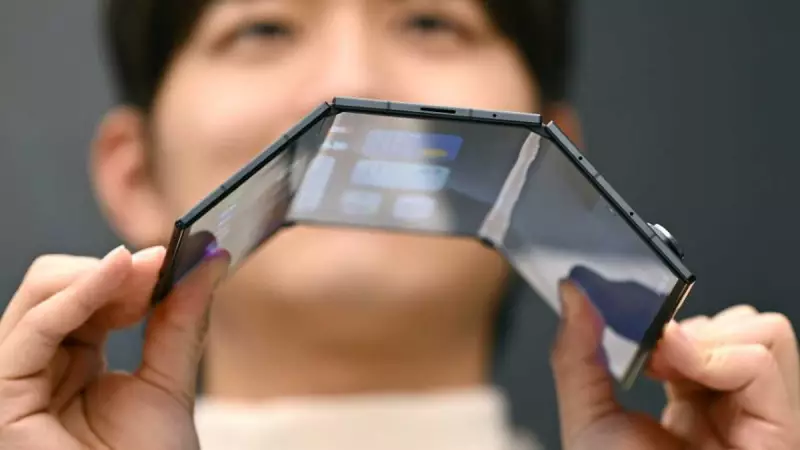

In corporate news, South Korean technology giant Samsung Electronics saw its shares surge more than 2% in Seoul trading. The rally coincided with the company launching its first-ever triple-folding smartphone. Samsung acknowledged the device's premium price tag, which exceeds $2,400, placing it far beyond the reach of the average consumer.

Here are the key financial figures as of around 02:30 GMT on Tuesday:

- Tokyo - Nikkei 225: UP 0.4% at 49,499.06

- Hong Kong - Hang Seng Index: UP 0.8% at 26,245.11

- Shanghai - Composite: DOWN 0.3% at 3,904.02

- Dollar/Yen: UP at 155.60 yen

- West Texas Intermediate Oil: UP 0.2% at $59.42 per barrel

- New York - Dow (previous close): DOWN 0.9% at 47,289.33

- London - FTSE 100 (previous close): DOWN 0.2% at 9,702.53