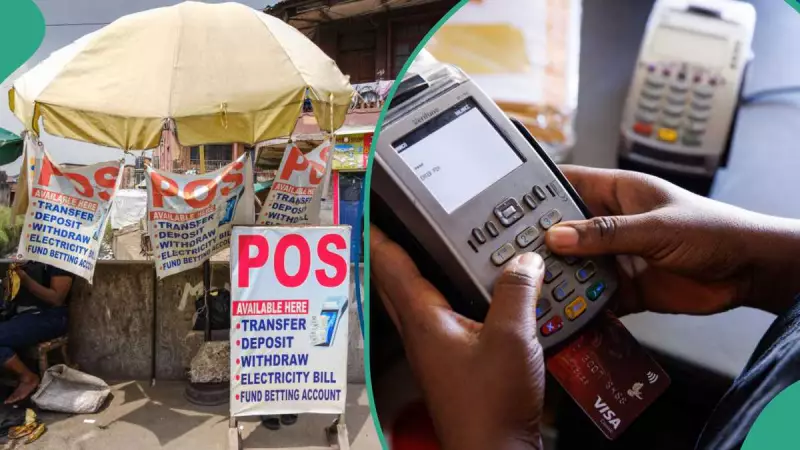

The Corporate Affairs Commission (CAC) has drawn a line in the sand for Nigeria's vast network of Point of Sale (PoS) operators, declaring January 1, 2026, as the final enforcement date for mandatory business registration. This decisive move aims to bring order and accountability to the country's sprawling financial agent network.

No Registration, No Business: The New Reality for POS Agents

In a firm public notice, the CAC stated that operating a PoS business without formal registration will become illegal from the start of 2026. The Commission expressed serious concern over the high number of agents functioning outside the Companies and Allied Matters Act (CAMA) 2020 and the Central Bank of Nigeria's Agent Banking Regulations.

The CAC warned that the proliferation of unregistered agents, often facilitated by some fintech companies, poses a substantial threat. This practice, it said, endangers the integrity of Nigeria's financial system and leaves ordinary citizens vulnerable to fraud and potential loss of funds.

Enforcement and Consequences for Non-Compliance

The Commission has outlined strict consequences for those who fail to meet the deadline. Security agencies have been directed to seize and shut down unregistered PoS terminals found in operation after January 1, 2026. Furthermore, a regime of constant monitoring will be implemented to identify non-compliant agents.

Fintech companies that enable or support illegal PoS operations will not be spared. The CAC stated that such companies will be placed on a watchlist and reported to the Central Bank of Nigeria (CBN) for further regulatory action. The notice emphatically urged all operators, including agents, super agents, and aggregators, to regularize their status immediately, stating that "compliance is mandatory, must be obeyed."

CBN's Geo-Tagging Rules Add Another Layer of Regulation

This crackdown coincides with new regulations from the Central Bank of Nigeria targeting PoS terminal management. In a circular dated August 25, 2025, the CBN ordered banks and fintechs—including major players like Moniepoint, OPay, and PalmPay—to geo-tag all PoS terminals across the nation within a 60-day window.

Under this policy, every PoS machine must be equipped with GPS and linked to the National Central Switch. Each device will be restricted to operating within a 10-metre radius of its registered business address. Any terminal used outside its approved location risks being automatically disabled, adding a technological enforcement layer to the CAC's registration drive.

The January 2026 deadline follows earlier registration windows extended by the CAC in 2024, which many operators failed to utilize. The Commission insists that formal registration is the cornerstone for reducing fraud, enhancing consumer protection, and ensuring the long-term stability of Nigeria's critical agent banking ecosystem.