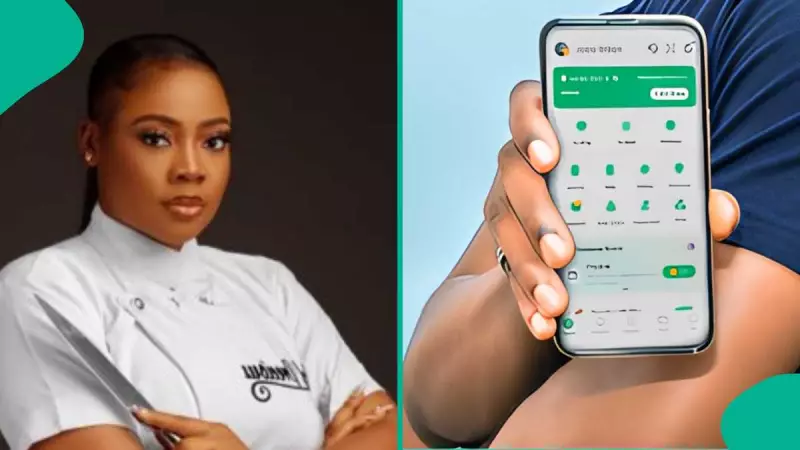

A Nigerian businesswoman has become an internet sensation after revealing an unexpected financial experience with the popular fintech platform OPay. The woman, identified as Precious Bernard, discovered that someone had sent money to her phone number through OPay despite her never having opened an account with the service.

The Unexpected Financial Surprise

According to Precious Bernard, who shared her story on social media platform X, she had never used her phone number to create an OPay account before the incident. However, when someone initiated a transfer to her mobile number through the fintech platform, the money automatically found its way into an account associated with her phone number.

The funds remained in this digital wallet, patiently waiting for her to claim them. Precious explained that when she eventually decided to open an OPay account using the same phone number, she was astonished to find the transferred amount readily available in her new account.

Social Media Reactions and Explanations

The woman's post quickly went viral, sparking numerous reactions from social media users who shared similar experiences and offered explanations for how the system works. One user, @Twelve_Oh_Nine, suggested that "if you've used any OPay service before they started banking, then you have an account."

Another respondent, @Toriaa_B, noted that other fintech platforms operate similarly, stating "Yessss, they operate like that because you alone have that phone number. I think palmpay moved like that initially."

Several users praised the system's security measures. @Michael_koker commented, "That's how they've been moving. I like it sha. They safeguard the money till you open an account and claim it," while @JuneCribb appreciated the convenience, noting "isn't it good? you can access the money without going to the bank for a week begging them to rectify it."

How OPay's System Protects Users

The incident highlights the sophisticated security measures employed by Nigerian fintech companies. According to user @Shegun_Eji, "Its normal, your number is registered with BVN. So automatically its registered as your name, even without having OPay, its stored."

However, not all mistaken transfers have happy endings. User @__kadibia shared a contrasting experience: "I mistakenly transferred money to a wrong OPay account the guy was telling me that God had answered his prayer. I wish it was an hausa guy I would have gotten my money back."

Another user clarified that unclaimed funds typically get reversed to the sender's account after approximately 48 hours, providing a safety net for mistaken transfers.

The story of Precious Bernard's unexpected financial windfall demonstrates how Nigerian fintech platforms are revolutionizing banking services, making financial transactions more accessible while maintaining security protocols that protect both senders and recipients in the digital banking ecosystem.