The United States Federal Reserve is heading into its last monetary policy meeting of 2025 this week, with an unusually high level of internal disagreement clouding the path forward. Financial markets, however, are betting heavily on a third consecutive interest rate cut.

A House Divided on Monetary Policy

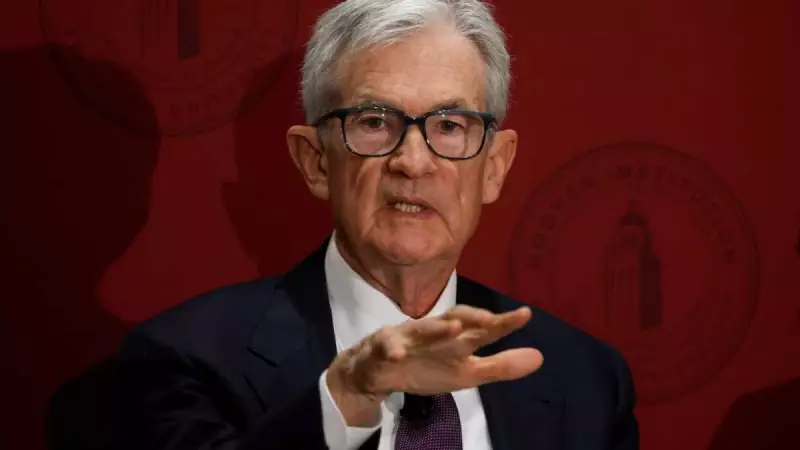

When the Fed met in October, Chair Jerome Powell cautioned that a December cut was "not a foregone conclusion," highlighting the "strongly differing views" among officials. This division stems from conflicting economic signals. On one hand, minutes from recent meetings reveal that many Fed officials anticipate a further rise in underlying goods inflation, partly driven by tariffs implemented under President Donald Trump.

On the other hand, a weakening labour market has prompted other leading figures to advocate for more rate cuts to support the economy, even though inflation remains stubbornly above the Fed's 2% target. UniCredit bank analysts described the upcoming decision in the "deeply divided" Fed as "too close to call."

The Data Void and Market Expectations

Complicating the Fed's data-dependent approach is a significant information gap. A US government shutdown from October 1 to November 12 disrupted the collection and publication of crucial economic statistics. As a result, full reports on October's jobs and consumer inflation figures have been cancelled.

This leaves policymakers with an incomplete picture as they debate their next move. Gregory Daco, Chief Economist at EY-Parthenon, pointed out the paradox: "The Fed says these decisions will be data-dependent, but there isn't a lot of data to go on." Despite the uncertainty, futures markets tracked by CME FedWatch show more than an 87% probability of a cut, which would bring the benchmark rate to a range of 3.50% to 3.75%.

Leadership Signals and Future Uncertainty

A notable shift in tone came from John Williams, President of the influential New York Fed, who on November 21 suggested rates could move lower in the "near term." This comment, seen by UniCredit as a significant "intervention," sparked a market rally and led analysts to believe he likely had Powell's approval.

Looking beyond this week's meeting, the Fed is on the cusp of major leadership change. Powell's tenure as Chair concludes in May 2026. President Trump, a frequent critic of Powell's rate policy, has signalled that his chief economic adviser, Kevin Hassett, could be a potential successor. While Hassett aligns with Trump on key issues, analysts note that institutional pressures often foster independence in Fed appointees.

UniCredit warned that while direct political interference may have a modest short-term impact, the risk of the Fed losing its de-facto independence under a second Trump term is "a non-negligible risk." The outcome of this week's divided meeting may set the stage for an even more turbulent year ahead for the world's most powerful central bank.