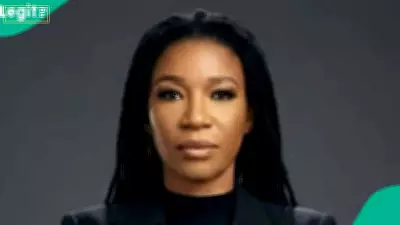

The Federal High Court in Abuja has delivered a landmark verdict in a high-profile financial crime case, sentencing former Managing Director of the Nigeria Export-Import Bank (NEXIM), Robert Orya, to a staggering 490 years in prison. This unprecedented sentence follows his conviction for a massive ₦2.4 billion fraud scheme that occurred during his tenure from 2011 to 2016.

Court Delivers Maximum Sentence on All Counts

In a decisive ruling on Thursday, February 5, 2026, Justice F.E. Messiri of the Abuja High Court found Orya guilty on all 49 counts brought against him by the Economic and Financial Crimes Commission (EFCC). The court imposed the maximum penalty of 10 years imprisonment for each individual count, resulting in the cumulative 490-year sentence that has sent shockwaves through Nigeria's financial and anti-corruption sectors.

EFCC's Successful Prosecution

The EFCC, through its official X handle, confirmed the successful prosecution led by Samuel Ugwuegbulam, who meticulously presented evidence that proved Orya's involvement in the ₦2.4 billion fraud beyond reasonable doubt. The anti-graft agency's statement emphasized that this conviction represents a significant victory in Nigeria's ongoing battle against corruption within financial institutions.

The EFCC statement read: "The EFCC, today, February 5, 2026, secured the conviction of Robert Orya, a former Managing Director, Nigerian Import Export Bank, NEXIM (2011-2016), for a fraud of about N2.4 billion. Orya, who was prosecuted by EFCC's Samuel Ugwuegbulam, was convicted by Justice F.E. Messiri of the FCT High Court, Abuja and sentenced to ten years imprisonment on each of the 49 count charges."

Implications for Nigeria's Anti-Corruption Fight

This case marks one of the most severe sentences ever handed down for financial crimes in Nigeria's judicial history. Legal experts suggest that the 490-year sentence, while largely symbolic given human lifespan limitations, sends a powerful deterrent message to public officials and banking executives who might consider engaging in fraudulent activities. The ruling demonstrates the judiciary's willingness to impose maximum penalties for egregious financial crimes that undermine Nigeria's economic stability.

The conviction of a former bank managing director of such a prominent financial institution highlights ongoing challenges within Nigeria's banking sector and reinforces the importance of robust oversight mechanisms. Anti-corruption advocates have praised the EFCC's diligent investigation and prosecution, viewing this outcome as evidence that Nigeria's anti-corruption agencies can successfully pursue high-profile cases against powerful individuals in the financial sector.