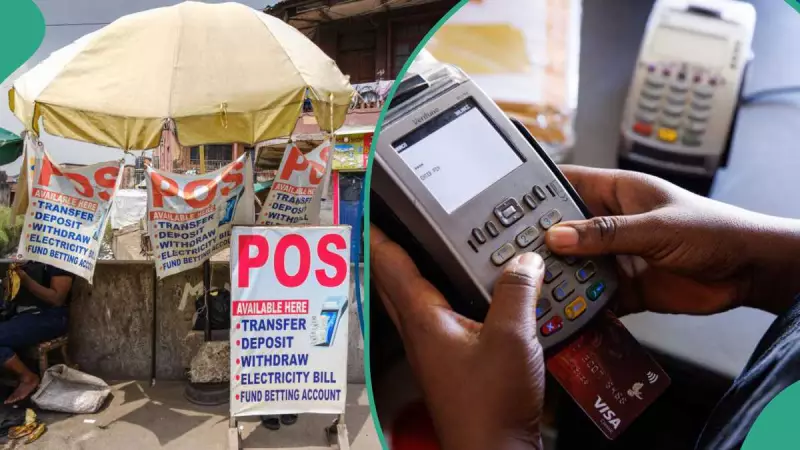

The Nigeria Inter-Bank Settlement System is poised to revolutionize financial access by launching offline payment solutions, targeting millions of Nigerians who face challenges with unreliable internet connectivity. This initiative is designed to deepen financial inclusion and ensure that no one is left behind in the rapidly evolving digital payments landscape.

Inclusive Innovation for All Nigerians

Speaking at the 2026 Chief Human Resources Officers Conference in Lagos, Ngover Nwankwo, Executive Director for Business and Products at NIBSS, emphasized that the next wave of payment innovation must be inclusive by design. She highlighted that while digital payments are expanding quickly, a significant portion of the population struggles with poor connectivity, limited data access, and low digital literacy. Offline payments are seen as a crucial bridge to address these gaps and bring more Nigerians into the formal financial system.

The Enduring Role of Cash in Nigeria

Nwankwo stressed that despite the growth of electronic transactions, cash remains a cornerstone of Nigeria's economy and daily life. She dismissed notions of eliminating cash in the near future, advocating for a coexistence of cash and digital platforms to protect those who rely on traditional methods while offering secure services to digital users. She praised Nigerian banks for recent operational improvements, noting smooth cash availability during the busy December 2025 period, which reflected better planning and coordination across the banking sector.

Advancing Biometric Solutions for Simpler Access

Beyond offline payments, NIBSS is also pushing forward with biometric solutions to simplify access to financial services. Nwankwo highlighted innovations such as fingerprint-based authentication for requesting and verifying payment cards, which reduces paperwork and documentation barriers. These advancements are particularly vital for underserved and rural communities where formal identification remains a significant challenge.

Global Cash Trends and Policy Implications

At the same conference, Lloyd Onaghinon, Managing Director of Bankers Warehouse Plc, presented a paper noting that cash usage continues to grow globally, driven by factors like culture, demographics, trust, and financial inclusion. However, he warned that excessive cash held outside the banking system weakens financial intermediation and limits monetary policy effectiveness. He called for closer collaboration among regulators, banks, and stakeholders to achieve a sustainable balance between cash, electronic payments, and emerging digital currencies.

CBN's Push to Formalize Idle Cash

In a goodwill message, the Central Bank of Nigeria urged financial institutions to partner more closely with fintech companies and microfinance institutions to bring idle cash into the formal system. Solaja Olayemi, CBN Director for Other Financial Institutions Supervision, revealed that about 90 percent of Nigeria's cash remains outside the banking system. He noted that fintechs and technology-driven microfinance institutions, with their wider agent networks in underserved areas, are key to addressing this issue. Olayemi added that companies like Moniepoint, OPay, and Kuda now hold national licences, with several other fintechs in the licensing process.

Combating Digital Fraud Through Collaboration

Other speakers at the conference emphasized the need for stronger collaboration to tackle rising digital fraud across banks, fintechs, telecom operators, and regulators. They called for stricter enforcement of Know Your Customer protocols, shared threat intelligence, improved vendor risk management, and sustained customer education. Participants agreed that layered security and collective action are essential to building a safe, inclusive, and resilient payments ecosystem as Nigeria moves toward offline and next-generation payment solutions.

Recent Fraud Trends in Nigeria

Legit.ng earlier reported that the Nigeria Inter-Bank Settlement Systems identified social engineering as the most prominent fraud technique in Nigeria's banking and digital payments ecosystem, despite a sharp drop in overall fraud losses in 2025. Premier Oiwoh, Managing Director of NIBSS, disclosed at an industry event in Lagos that fraud losses declined by 51 percent to N25.85 billion in 2025, compared with N52.26 billion recorded in 2024. This highlights ongoing efforts to enhance security and protect users in the digital finance space.