Virtual vs Physical Crypto Debit Cards: Which Option Best Fits Your Spending Habits?

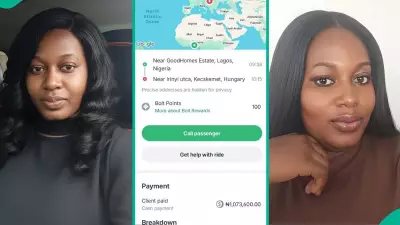

Crypto debit cards have revolutionized how cryptocurrency holders can utilize their digital assets for everyday transactions. These innovative financial tools seamlessly connect the world of cryptocurrency with traditional payment systems, allowing users to spend their crypto balances directly without needing to convert funds in advance. Whether you're shopping online, paying for subscriptions, or making purchases at physical stores, crypto debit cards provide a practical solution for integrating digital currencies into daily life.

How Crypto Debit Cards Function

A crypto debit card operates differently from conventional bank-linked cards by drawing directly from your cryptocurrency balance. When you make a payment, the card provider instantly converts the required amount of cryptocurrency into fiat currency at the current exchange rate. This conversion happens seamlessly at the point of sale, making the transaction appear as a standard card payment to merchants. No special cryptocurrency acceptance is required from stores, meaning these cards work anywhere traditional debit cards are accepted.

The beauty of this system lies in its simplicity and immediacy. You don't need to pre-exchange your cryptocurrency or maintain separate fiat balances. The card handles everything automatically, providing real-time conversion that reflects current market rates. This functionality has made crypto debit cards increasingly popular among both cryptocurrency enthusiasts and everyday users looking for alternative payment methods.

Virtual Crypto Debit Cards: Digital-Only Convenience

Virtual crypto debit cards exist exclusively in digital format and are typically issued immediately upon registration. These cards are designed primarily for online transactions, including website purchases, subscription services, and in-app payments. Users can easily add virtual cards to digital wallets like Apple Pay or Google Pay, creating a streamlined payment experience for mobile and online shopping.

The advantages of virtual crypto debit cards include:

- Instant access: No waiting period for card delivery

- Enhanced security: Digital cards can be quickly replaced if compromised

- Convenience: Always available on your smartphone or smartwatch

- Eco-friendly: No plastic production or physical waste

However, virtual cards do have limitations. They generally cannot be used for cash withdrawals at ATMs and may not work at physical stores that require card-present transactions. Some merchants, particularly those with older payment systems, might not accept virtual card payments for in-person purchases.

Physical Crypto Debit Cards: Traditional Plastic with Crypto Power

Physical crypto debit cards resemble standard plastic debit cards but draw from cryptocurrency balances instead of bank accounts. These cards function identically to traditional payment cards for both online and in-store purchases, and they enable cash withdrawals at ATMs worldwide. This makes physical crypto cards particularly suitable for users who frequently shop at brick-and-mortar stores or need access to cash.

The benefits of physical crypto debit cards include:

- Universal acceptance: Works anywhere regular debit cards are accepted

- ATM access: Enables cash withdrawals when needed

- Familiar format: Provides the tangible experience of traditional cards

- Backup option: Can be used when digital payments aren't available

Physical cards do come with some drawbacks. Users typically need to wait for delivery, which can take several days or weeks depending on location. There may be issuance fees, maintenance charges, or replacement costs. Additionally, like any physical object, these cards can be lost, stolen, or damaged, requiring replacement procedures.

Making the Right Choice for Your Needs

The decision between virtual and physical crypto debit cards ultimately depends on your spending patterns and lifestyle requirements. If most of your transactions occur online or through mobile payments, a virtual card likely provides sufficient functionality without the need for physical plastic. The convenience of having your card always available on your devices, combined with enhanced security features, makes virtual cards ideal for digital-native users.

Conversely, if you frequently shop at physical stores, dine at restaurants, or require access to cash through ATMs, a physical crypto debit card offers greater versatility. The familiar plastic format ensures compatibility with all payment terminals and provides a reliable backup when digital systems fail or aren't available.

Many cryptocurrency platforms now offer both virtual and physical card options, allowing users to maintain both formats for different situations. This hybrid approach enables you to use a virtual card for online purchases and mobile payments while keeping a physical card for in-store transactions and cash access. Some providers even allow seamless switching between formats or offer virtual cards that can later be upgraded to physical versions.

When selecting your crypto debit card, consider factors beyond just the physical vs virtual distinction. Evaluate associated fees, supported cryptocurrencies, exchange rates, security features, and customer support. Some cards offer additional benefits like cashback rewards, lower transaction fees, or integration with multiple cryptocurrency wallets.

Both virtual and physical crypto debit cards represent significant advancements in cryptocurrency adoption, making digital assets more practical for everyday use. By understanding the strengths and limitations of each format, you can choose the option that best aligns with your financial habits and maximizes the utility of your cryptocurrency holdings in the real world.