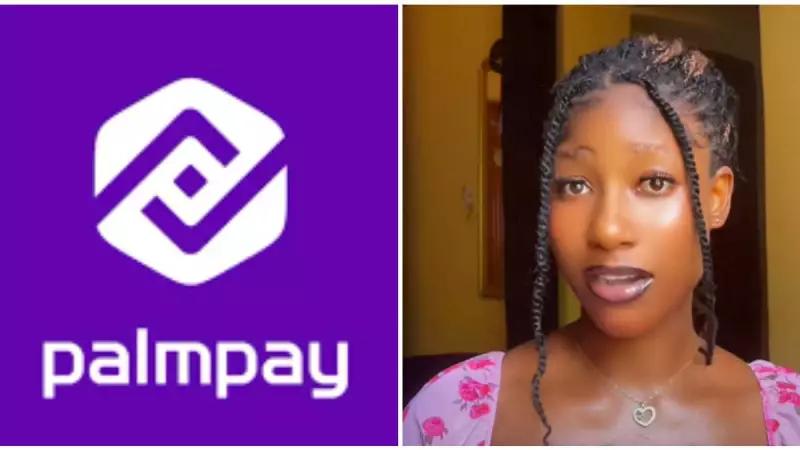

Trusted Fintech Apps in Nigeria: PalmPay User Shares Inspiring Journey

Are you searching for a reliable fintech application that can handle seamless transactions while also helping to scale your business operations? For countless Nigerians, the primary criterion when evaluating financial technology platforms revolves around one fundamental question: Can this platform be trusted with my money and my financial future?

How PalmPay Transformed a Young Entrepreneur's Business

This was precisely the situation for Happiness, a determined young Nigerian entrepreneur who needed a trustworthy digital platform to expand her business and strengthen her brand identity. She discovered PalmPay, which quickly became more than just a secure fintech solution—it evolved into a genuinely rewarding platform that played a significant role during pivotal moments in her life.

Throughout 2025, Happiness depended entirely on PalmPay to manage her business operations. The application facilitated everything from receiving customer payments and settling vendor invoices to overseeing daily financial transactions. When PalmPay launched its Hustle Grant Campaign, she joined thousands of other small business owners competing for the N500,000 funding opportunity.

Although Happiness did not make the final shortlist for the grant, the campaign provided her business with something equally valuable: increased visibility. New customers discovered her brand through the platform, inquiries multiplied, and sales consequently improved. PalmPay did not merely organize a promotional campaign; it cultivated an ecosystem where small enterprises could gain exposure and receive meaningful support.

PalmPay's Crucial Role During Personal Crisis

Just days after applying for the PalmPay Hustle Grant, Happiness faced a life-altering personal tragedy. On August 30, 2025, she lost her father unexpectedly. This devastating loss brought immediate financial challenges, particularly concerning urgent payment requirements.

When traditional banking channels repeatedly declined their transaction attempts, Happiness suggested using her PalmPay account. The transfer processed successfully without complications. During this period defined by grief and urgency, PalmPay demonstrated that reliability transcends being merely a feature—it becomes an essential lifeline when conventional systems falter.

Beyond Transactions: Building Financial Discipline

Happiness's relationship with PalmPay extended far beyond basic payment processing. Through the application's comprehensive management tools, she developed stronger financial discipline and learned to implement better money management practices. PalmPay transformed from a simple transactional tool into a genuine financial partner that helped cultivate healthier financial habits.

The platform continues to reward user loyalty through ongoing initiatives like the Premier Cool campaign, which reinforces a straightforward message: consistent financial responsibility should deliver tangible value. The campaign's premise is simple—purchase a bar of soap and potentially win ₦10,000 cash alongside other monetary benefits. This represents PalmPay's philosophy that intelligent financial habits deserve real-world rewards.

Why PalmPay Earns User Trust in Nigeria's Fintech Landscape

Life rarely provides warnings before testing our resilience. When challenges arise unexpectedly, individuals need platforms that don't merely function occasionally but perform reliably every single time. For numerous Nigerian users, PalmPay has proven to be more than just another payment application. It serves as a trusted financial partner that powers ambitions, supports users through defining life moments, and facilitates smarter banking practices.

When circumstances demanded absolute reliability, PalmPay delivered without hesitation. The platform's combination of seamless transaction capabilities, business growth opportunities, and personal support during crises establishes it as a trustworthy option within Nigeria's rapidly evolving fintech ecosystem.