Former Nigerian Export-Import Bank Chief Receives 490-Year Prison Sentence for Massive Fraud

The Economic and Financial Crimes Commission (EFCC) has secured a landmark conviction against Robert Orya, the former Managing Director of the Nigerian Export-Import Bank (NEXIM). On Thursday, February 5, Justice F.E. Messiri of the Federal Capital Territory High Court in Abuja delivered the verdict, sentencing Orya to a cumulative 490 years in prison for his involvement in a fraudulent scheme amounting to approximately N2.4 billion.

Details of the Conviction and Sentencing

Orya faced prosecution by EFCC counsel Samuel Ugwuegbulam on 49 separate count charges related to financial misconduct during his tenure at NEXIM. The court found him guilty on all counts, imposing a sentence of 10 years imprisonment for each charge. This unprecedented sentencing reflects the severity of the offenses and marks a significant victory for Nigeria's anti-corruption efforts.

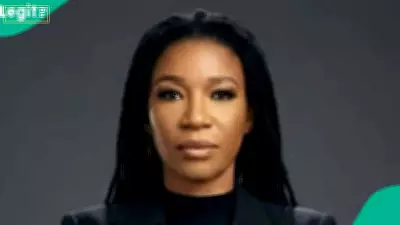

Background of the Former Bank Executive

Robert Orya, a finance expert from Benue State, assumed leadership of NEXIM in August 2009, heading the bank's executive management team. Beyond his role at NEXIM, Orya held the prestigious position of honorary president of the Global Network of Export-Import Banks and Development Finance Institutions, adding irony to his fall from grace.

Public Reaction and Social Media Trends

The sentencing has ignited intense discussion across social media platforms, particularly on X (formerly Twitter), where Nigerians have been actively commenting on the development. Many citizens have expressed both shock at the scale of the fraud and approval of the court's decisive action, viewing it as a positive step in combating corruption within Nigeria's financial institutions.

Broader Implications for Financial Governance

This case represents one of the most substantial convictions in recent Nigerian financial crime history. The EFCC's successful prosecution demonstrates the agency's commitment to holding high-profile individuals accountable, regardless of their previous positions or connections. Legal experts suggest this verdict may set a precedent for future cases involving substantial financial malfeasance in Nigeria's banking sector.

As the news continues to develop, observers await potential appeals and further legal proceedings. The case has already become a focal point in discussions about transparency, accountability, and ethical leadership within Nigeria's financial institutions.