Politics

Oyetola Celebrates Bisi Akande at 87, Highlights His Democratic Legacy

Minister Adegboyega Oyetola congratulates elder statesman Chief Bisi Akande on his 87th birthday, praising his pivotal contributions to Nigeria's democracy and mentorship of leaders. Read more about his enduring impact.

Business

NESG Forecast: Naira to Trade at N1,480/$1 in 2026 Amid Economic Reforms

The Nigerian Economic Summit Group forecasts the naira will stabilise around N1,480 per US dollar in 2026, driven by rising reserves and policy coordination. Discover the full economic outlook.

Entertainment

Pastor Chris Okafor's Canada Church Reportedly Shuts Down Amid Scandal

The Toronto branch of Pastor Chris Okafor's Liberation City church has allegedly been dissolved following a scandal involving women, including actress Doris Ogala. Fans react.

Security

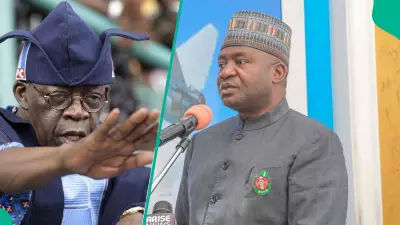

Defence Minister Musa: Tinubu's Govt Does Not Pay Ransom to Kidnappers

Nigeria's Defence Minister, Christopher Musa, has denied the Federal Government pays ransom for kidnap victims. He insists military pressure and intelligence are the strategy. Read the full details.

Sports

Education

Culture

Nigerian Lady Calls for Bride Price Ban, Sparks Debate

A Nigerian woman's viral TikTok video demanding the abolition of bride price has ignited fierce online debate. She argues the tradition promotes ownership and financial exploitation. Read the full story and reactions.

Mastering Nigeria's 371 Ethnic Food Traditions

Explore the rich culinary heritage of Nigeria, from communal cooking to 7 essential steps for mastering traditional dishes like jollof rice, egusi soup, and pounded yam. Discover how food defines identity.

Masquerade Attacking Singer at Ofala Festival Arrested

Anambra Police have arrested a masquerade for violent attacks at the Ofala festival in Awgbu. Read the full details of the incident and police action.

Man Leaves Faith Over Church's Snub of Late Senator Ubah

A dramatic scene unfolded as James Louise Okoye renounced his Christianity at a cathedral dedication in Nnewi, protesting the church's failure to honour late Senator Ifeanyi Ubah. Full story inside.

Lady Cancels Wedding Over Mother-in-Law's Remarks

A Nigerian woman shares why she called off her wedding in 2022 after her fiancé's mother made derogatory comments about her family's status. Her story sparks a major conversation on social media.

Health

Get Updates

Subscribe to our newsletter to receive the latest updates in your inbox!

We hate spammers and never send spam