Politics

Rivers Crisis Deepens: 4 Lawmakers Reverse Stance, Back Fubara's Impeachment

Four Rivers State lawmakers who sought peace have reversed course, declaring support for Governor Fubara's impeachment. They cite a lack of remorse from the governor. The political crisis escalates.

Business

NEC Sets Up Bipartisan Panel on Tinubu's Legacy Projects, Pushes Non-Oil Revenue

Nigeria's NEC resolves to accelerate non-oil revenue, forms a bipartisan committee for Tinubu's legacy projects, and reviews economic priorities for 2026. Read the full details.

Entertainment

Wizkid & Asake Drop 'Jogodo' as Lead Single from Joint EP 'Real'

Afrobeats superstars Wizkid and Asake have released their new single 'Jogodo,' the lead track from their upcoming joint EP 'Real (Vol 1).' Get all the details on the release date and tracklist here.

Security

From Ese Oruru to Walida: Nigeria's Selective Outrage on Child Exploitation

A new case of alleged abduction & forced conversion of a Muslim girl by a DSS agent raises questions about Nigeria's selective public outrage, echoing the 2016 Ese Oruru saga. Read the full analysis.

Sports

Education

Culture

Group Cautions Against Derogatory Utterances on Alaafin

Oyo Ni Wa Tooto warns Ibadan Mogajis against undermining Alaafin's stature. Olubadan clarifies alleged snub was a misunderstanding. Read more on the royal protocol dispute.

Great Comet Approaches: Impact on Climate and Human Spirit

The Great Comet, heralded as the Second Coming of the Star of Bethlehem, approaches Earth, bringing spiritual awakening and climatic upheaval. Nigeria's missing harmattan is a direct sign. Explore the revealed knowledge and its urgent implications for hum

Toyin Ayinde to Deliver SGO Uyeh Public Lecture

Former Lagos Commissioner Toyin Ayinde will speak on Christian youth's role in national development at the SGO Uyeh Lecture Series in Ketu, Lagos, on January 17. Join the event!

Deeper Life Church's Shift: From Drums to Dress Codes

Deeper Life Bible Church, known for its strict doctrines, has gradually adopted practices it once rejected as worldly, including drums and modern media. Explore the evolution.

Group Warns Against Disrespect to Alaafin of Oyo

Oyo Ni Wa Tooto cautions Ibadan Mogajis over derogatory comments against Alaafin Oba Abimbola Akeem Owoade I, urging respect for Yoruba heritage and unity. Read the full statement.

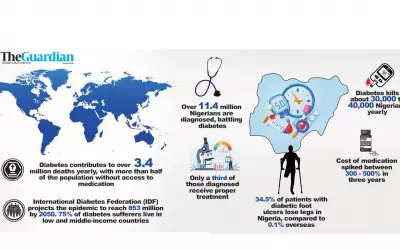

Health

Get Updates

Subscribe to our newsletter to receive the latest updates in your inbox!

We hate spammers and never send spam